Merrill Lynch Advisor

Summer 2003 Issue

![[logo]](jag1.jpg)

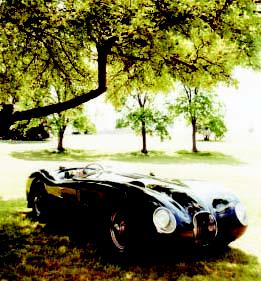

Should this roadster be in your portfolio?

By Michael Hirson

Photographs by Zubin Shroff

For some, investing in classic cars and fine art can be rewarding. But are collectibles your best choice for protection against market swings?

John Sweeney, executive director of the Larz Anderson Auto Museum in Brookline, Mass., spends a lot of time fine-tuning his portfolio. Not his stocks and bonds, but his "alternate portfolio" of classic cars and motorcycles, including several vintage Jaguars. "I�m attracted to cars and motorcycles that are design milestones-ones that would have stopped traffic in any era," says Sweeney, who drives or rides his vehicles every Sunday. "I also like them because they are durable assets that have increased in value over time."

The ability to own objects you feel passionate about has always been a way of enjoying wealth. But more investors have become attuned to another aspect of collectibles-their value as investments. The growth in auction Websites has made it easier for collectors to make trades. Just as significant is the bear market, which has driven home the importance of keeping a portion of assets in investments that aren�t directly tied to stocks and bonds. These "noncorrelated" assets include hedge funds, real estate, private equity and even collectibles.

Most Merrill Lynch Financial Advisors agree that hedge funds should be the first choice among noncorrelated assets. That�s because hedge funds are often designed to prosper in any market environment by allowing their managers maximum flexibility in their trading strategies. "Hedge funds have proved their value as a means of diversifying portfolios in recent years," says Len Brisco, a Financial Advisor in Century City, Calif. In 2002, for example, the average U.S. hedge fund lost 0.4%, according to Van Hedge Fund Advisors International, compared with the 22.1% drop in Standard & Poor�s 500-stock index. Brisco recommends that many of his wealthier clients allocate between 5% and 15% of their portfolios to hedge funds.

Real estate holdings, such as real estate investment trusts and limited partnerships, are another source of diversification. Although property prices are often affected by the stock market�s volatility, they�re also driven by factors such as interest rates and supply and demand in a given region. Even with the tumult in the markets, home prices rose 7% in 2002, according to the National Association of Realtors. Many Financial Advisors say an optimal weighting for real estate investments (not including primary residences) is between 5% and 10% of a wealthy client�s total net worth.

Buy high, sell higher

So what role can that classic car play in your portfolio? "The motive for collecting should be passion first, profits second," says Bruce Ledoux, Sweeney�s Financial Advisor. Ledoux, himself a car enthusiast, has several clients who collect classic cars. "But it is also important to recognize that collectibles are valuable assets that you should consider part of your total financial picture," he cautions.

In contrast to such traditional investments as stocks and bonds (or even hedge funds and real estate), it�s difficult-some would say impossible-to accurately measure the returns on collectibles as an asset class. That makes them highly speculative investments. Even the most glamorous corner of collecting, fine art, can be one of the hardest to profit in. "The people who consistently profit from art are the artists and the dealers," says Michael Findlay, former international director of fine arts at auction house Christie�s and currently director at Acquavella Galleries in Manhattan. "I tell collectors to buy an art work only if they can eventually forget what they�ve paid for it, whether it�s a $10,000 poster or $10 million Renoir," he says. In fact, art prices based on the New York auction market fell almost 5% in 2002, according to New York University business professors Jianping Mei and Michael Moses.

That�s why Merrill Lynch�s Brisco recommends that, rather than allocate a specific portion of their net worth to collectibles, as they would to stocks or hedge funds, investors should treat collectibles as luxury items. "Make sure you�ve taken care of your investment needs, both for current income and long-term growth," he says. "Then you can determine how much you can indulge your passion." It�s also important that investors budget for insurance and the expense of maintaining and protecting a collection-which for classic cars or large wine cellars can be considerable.

One of the most commonly heard pieces of advice for collectors is to "buy quality." While there�s nothing wrong with bargain hunting, it often makes sense to pay premium for items with recognized worth, a wide following and the ability to hold their value over time. There�s less chance these classics will fall out of favor or lack buyers should heirs need to sell.

That was the approach taken by Gordon and Kathy Nichols of Tiverton, R.I., also clients of Financial Advisor Ledoux. Three years ago, the Nicholses spotted an Austin Healey at a local yard sale. Gordon, who was then restoring a 1957 Porsche, wondered if it made sense to take on another project. "After we researched the price, we decided to buy the car partly as an investment," says Kathy.

Today, the Nicholses are happy with their decision. The Healey has appreciated 25%, and the couple, who recently retired from jobs in the tech sector, look for any excuse to drive it.

For many people, the most rewarding aspect of collecting is the chance to pass along beloved objects to the next generation. "It�s not just a painting or Ming vase you�re handing down, but a part of your passion for the things you love," says Evangeline Shears, a retired publishing executive who lives with her husband, Russell, in Southern California. The Shearses began buying art more than 40 years ago. Their love of California plein air paintings from the turn of the 19th century and Russian Impressionist and Realist paintings from the late-20th century drew them to those specialties before many other collectors. "Our children and grandchildren have grown up around these paintings, and I know which ones they love-they don�t have to tell me," Evangeline says.

Many people first confront the issue of taxes on their collections when drawing up an estate plan. "Clients begin to realize that these items are subject to the estate tax," says Len Brisco, the Shearses� Financial Advisor. "With the maximum estate tax at 49% in 2003, that can lead to a hefty tax liability for a valuable object." For instance, a painting purchased 10 years ago for $200,000 and now worth $500,000 will be, for estate tax purposes, valued at the higher rate. What�s more, when collectibles are sold they�re subject to capital gains tax on their appreciated value. In fact, the maximum long-term capital gains rate is 28%, higher than the current 15% maximum for stocks. Some collectors may even run into trouble with the Internal Revenue Service for failing to keep track of how much they paid for a piece, making it impossible to determine the collectible�s cost basis for capital gains.

One approach to reducing tax liability on collectibles is to gift them to family members during your lifetime; an individual is allowed to make gifts worth up to $11,000 per recipient annually. The drawback is that the recipients will inherit the cost basis for the collectibles, which could mean a sizable tax liability if those assets have appreciated significantly.

Tax benefits are also a reason to consider donating a collectible to a museum, nonprofit or charity. Besides reducing an estate�s value, donations result in a dollar-for-dollar tax credit against annual federal income tax within specified limits. "It is comforting to know that whatever we decide to donate will help protect the value of our estate," says Shears.

Of course, the fundamental lesson to keep in mind is that investors should buy what they love. They may just spot an object that will one day be worth many times its current price. But even if that turns out not to be true, the investor will enjoy the object over a lifetime-one reason it�s hard to find a serious collector who complains about his return on a purchase. "When I look at price guides, I�m often astounded at how much cars can appreciate," says Sweeney. "But I buy cars to own them for the rest of my life."

Click here to go to the previous page

Click on the box below for Merrill Lynch

© 2004/2015 Article provided to British Car Week by Merrill Lynch and Time Inc. Custom Publishing

www.britishcarweek.org